salt tax repeal june 2021

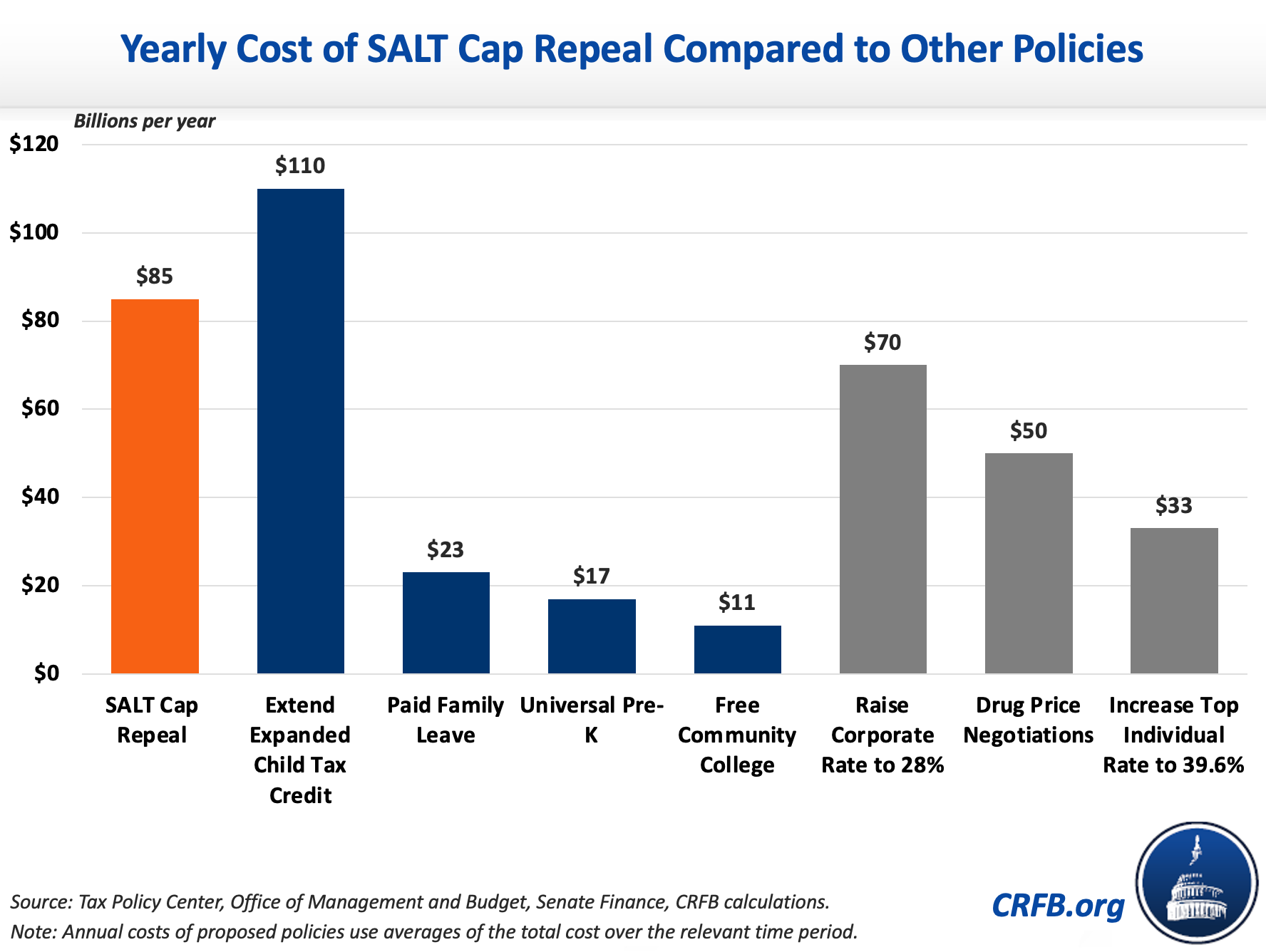

The 10000 cap imposed in 2017 as part of the Trump tax cuts will sunset in 2025. Doubling the cap to 20000 would remove the marriage penalty but it would reduce federal revenue.

Ending The State And Local Taxes Salt Deduction

During negotiations in the Senate on the 737 billion spending bill Republicans like South Dakota Sen.

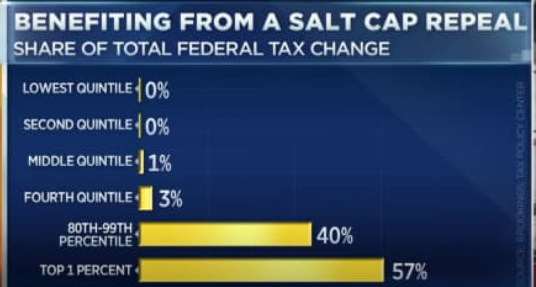

. Over 50 percent of this reduction would accrue to. June 1 2021 at 345 pm. Sales Tax Holiday Dates.

Some Democrats like Senates Wyden have offered their own ideas. By Jonathan Levin. June 1 2021 at 348 pm.

June 4 2021 457 PM. Contrast our proposal for a steady removal with the timeline of the SALT cap if Democrats decided on temporary full repeal. Letter writer says Andrew Wilfords opinion piece Repealing SALT would.

On June 22 2021 the Department issued SC Information Letter 21-17 which sets forth the sales tax holiday dates for this year. Two single filers may each take up to 10000 in SALT deductions but jointly filing means only one 10000 deduction can be taken. The Tax Cuts and Jobs Act.

December 20 2021 TOPICS The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in. These states offer a workaround for the SALT deduction limit For 2021 the standard deductions are 12550 for single filers or 25100 for married couples filing together meaning they wont. Argument against SALT tax repeal misleading.

Pushing to change key part of Trump tax law. Corporate income tax rate lack of SALT change remain sticking points. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

January 25 2021 Garrett Watson As President Joe Biden and policymakers in Congress consider changes in tax policy over the coming year the fate of the 10000 state and local tax SALT deduction cap will be an ongoing part of the policy debate. As negotiations continue on a bipartisan infrastructure agreement certain members of Congress from high-tax states are desperate to tack on a repeal of the 10000. The SALT cap workaround was enacted in 2021 in California and allows for business taxed as S corporations or partnerships to choose to pay a 93 state income tax.

Bernie Sanders to provide state and local tax SALT relief and what it could. June 28 2021 by Stellar ICRE in Industry News CNBCs Robert Frank takes a look at calls from Sen. No SALT cap up to 2018 A 10000 SALT Cap.

House Democrats pass package with 80000 SALT cap till 2030 Here are must-know changes for the 2021 tax season How to pay 0 capital gains taxes with a six-figure income In the meantime. September 14 2021 Key Points We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent.

One way to offset that cost would be to eliminate the state and local tax SALT deduction which is capped at 10000 through 2025 and tends to benefit higher-earning.

How Dems Can Get Out Of The Salt Mess And Save 1 Trillion

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

Online Counties Call For Repeal Of Salt Cap

Note To Bernie The 8 Arguments For Restoring The Salt Deduction And Why They Re All Wrong

East Coast Lawmakers Pepper Congress With Pleas For Salt Tax Break Iowa Capital Dispatch

On Salt Dems Push Tax Relief For The Rich Not The Middle Class Editorial Nj Com

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Deduction Cap Repeal Gottheimer And Suozzi Discuss Tax Cuts

New Report From Itep Describes Options For Changing The Salt Cap Without Repealing It Itep

Salt Cap Democrats Still Batting Around Ideas For How To Reinstate The Contentious Tax Rule

Law S Erik Jensen Weighs In On Salt Cap Repeal The Daily

Senate Democrats Effort To Overturn Salt Deduction Charitable Workaround Rule Fails Don T Mess With Taxes

Hold The Salt Please Baker Institute Blog

Congress And The Salt Deduction The Cpa Journal

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Minnesota Salt Cap Workaround Salt Deduction Repeal

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

As Dems Push Salt Cap Repeal Many States Have Ok D Workaround Fox Business

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation